Growing by acquisition is one way to grow, but it is not an easy endeavor. Additionally, every acquisition is different, and there is no cookie cutter approach to integrating two companies.

Having a plan in place to implement the recommendations from the due diligence, as well as the right integrations team of consultants to guide you through the initial integration process will increase your chances of a successful integration. It will minimize the impact to the day to day business operation.

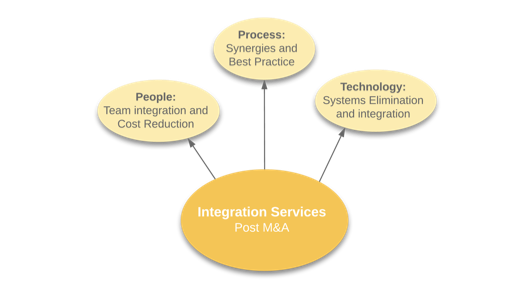

Once a company has been legally acquired and purchased, our consultants can be brought in as the buyer’s M&A Integrations team that would be responsible for identifying and documenting how the acquired company operates (from quote-to-cash) and develop a complete plan to integrate the two companies to operate as one coherent and profitable unit.

Successful integrations can be measured by:

• An increase to the overall EBITDA (Reduced operational expenses)

• A reduction in stress, companywide (added efficiencies)

• Higher productivity

• Right people on the right role.

• Wider range of products and service offerings.

Methodology

• In person interviews with Key Stakeholders (discovery)

- How many roles do key employees work?

- How much time spent on each role?

- What other skills do they have and what do they enjoy doing?

• Document how the company operates (critical processes)

• Learn what tools they use daily (operationally).

• Understand what technologies are required to run the business.

• Identify redundancies / synergies.

• Closely integrate teams (Right person on the right role).